Let's deep dive into the areas that challenger banks (or often called “Neo Banks”) expand to increase Share of Wallet. In banking, Share of Wallet, refers to the percentage of a customer's total financial activities, such as deposits, loans, or investments, that a bank manages.

It's a strategy where the bank aims to increase the amount of financial services used by existing customers rather than focusing solely on acquiring new customers. This is because it's often more cost-efficient to deepen relationships with current customers than to attract new ones.

In this blog we aim to focus on the methods most frequently used by challenger banks to increase the Share of Wallet, namely:

💸 Cashback

🧳 Saving accounts and deposits

💰 Investment products

💳 Credit cards

🤝 Loans

💎 Premium accounts

✈️ Travel booking

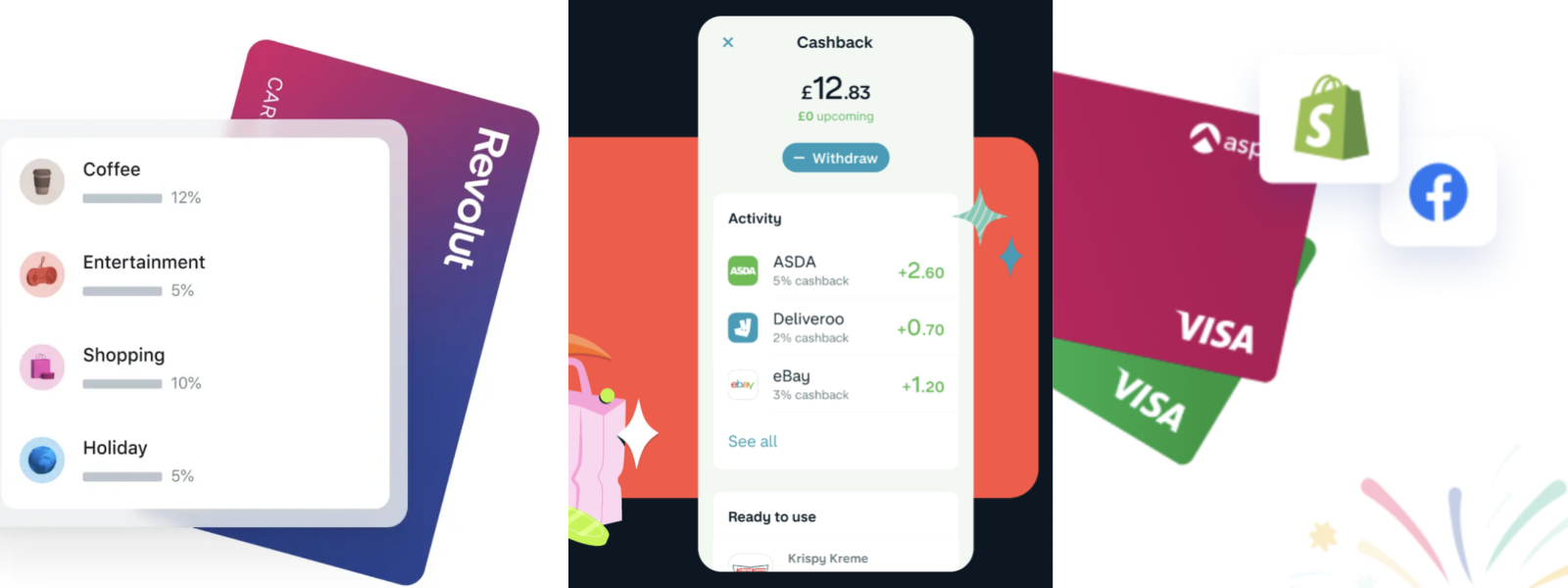

Cash back

A popular product across a lot of retailers, banks and credit card providers is Cash Back. Banks use cash back as an incentive to attract and retain customers. By offering a small percentage of purchases back as cash, banks can encourage their customers to use their credit or debit cards more frequently. This in turn generates more revenue for the bank in the form of transaction fees paid by merchants (interchange). Additionally, customers who earn cash back may view this as a form of savings, increasing their satisfaction and loyalty to the bank, resulting in using other services of the bank more as well.

Banks pay for cash back primarily through interchange fees, which are fees charged to merchants for each transaction processed with a credit or debit card. These fees usually range from 1% to 3% of the total transaction amount, and a portion of these fees is used to fund the cash back rewards. Additionally, banks may also earn interest from the money that cardholders borrow when they carry a balance on their credit cards.

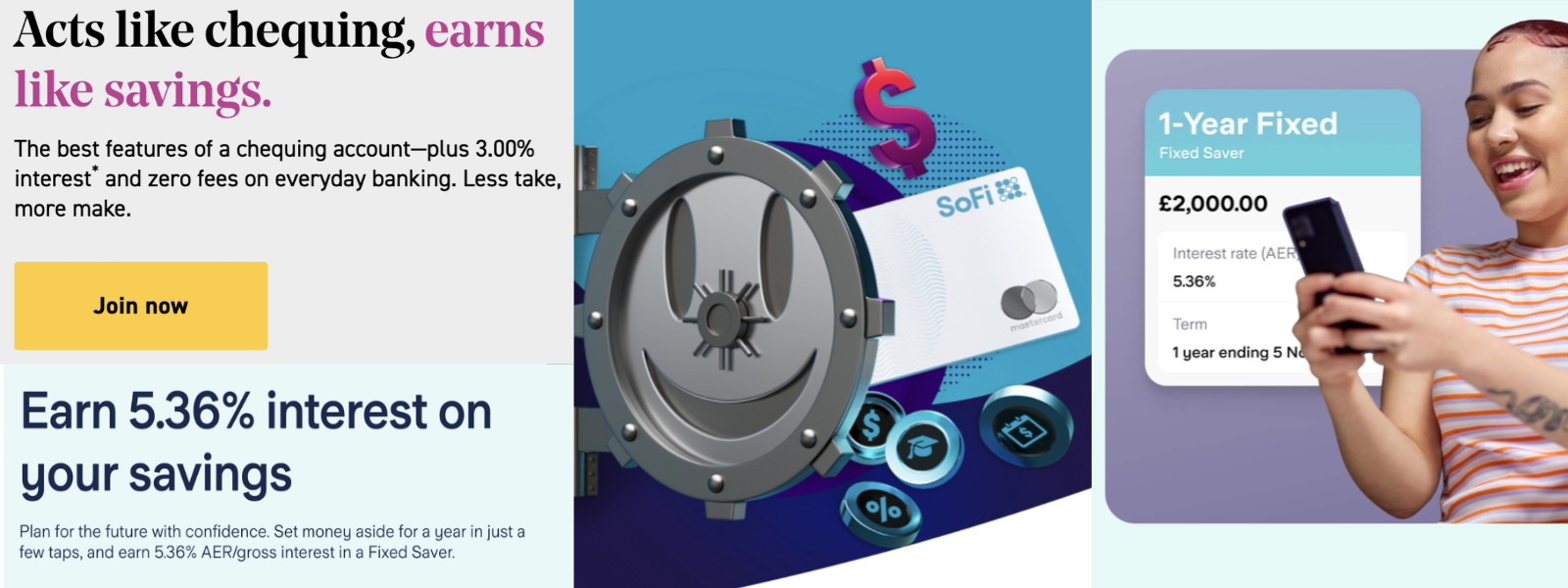

Saving products and deposits

With interest rates on the rise the last months across the globe, many Challenger Banks started offering saving accounts if they didn’t do so already. Most of them try to attract their customers moving money into their accounts by offering competitive interest rates compared to high street banks and often with the option to be able to take out the money from their accounts whenever they need without paying a fine. Not only that, but also earning the interest on monthly base and some challenger banks like Revolut even payout interest on a daily base.

What is in it for the banks? Well that is easy, they still pay out interest lower than they will get lending or depositing it somewhere else, making it a new revenue stream.

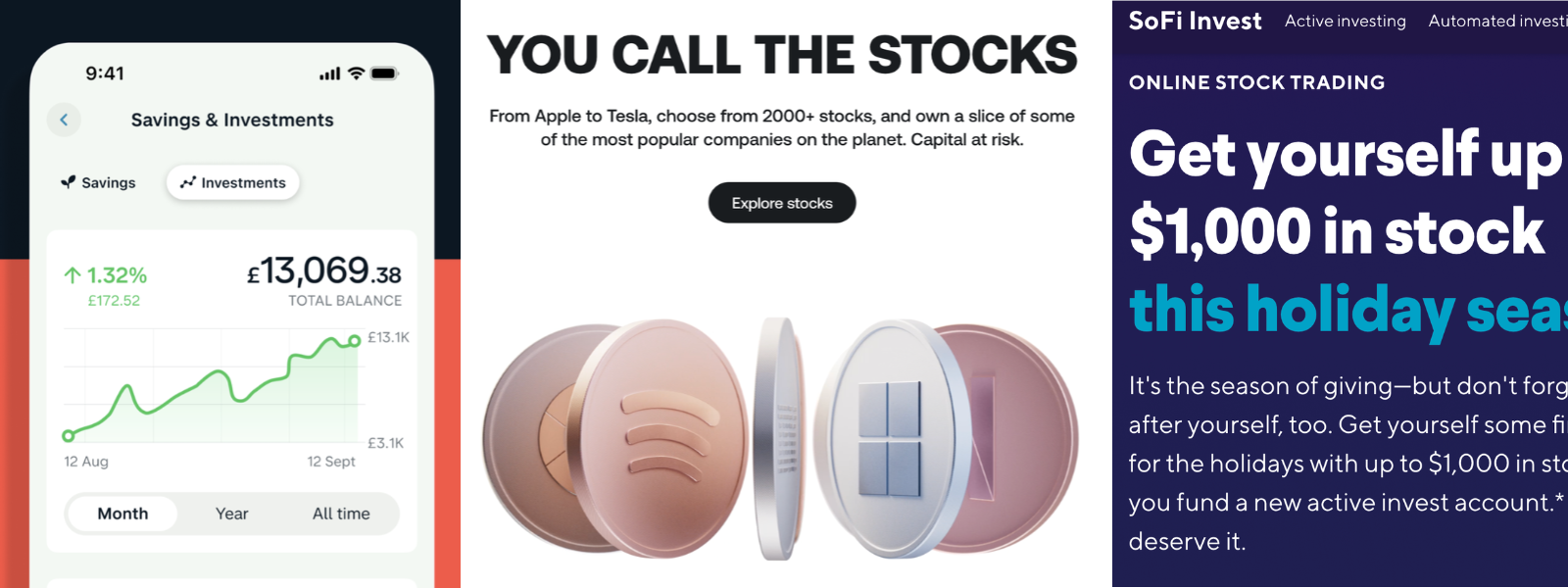

Investment products

Many Neo Banks, despite the risk and uncertainty, have started offering various forms of investment products. Examples include Wise with Wise Assets, Monzo with Monzo Investments, and Revolut which offers multiple forms, including Crypto and stock. Often, these banks partner with larger investment funds like BlackRock, as Monzo has done. This strategy allows them to avoid acquiring new talent and building an entire investment product from scratch, instead functioning as an affiliate of an established investment fund.

Insurance

While it's still relatively early days for most challenger banks, the majority already offer insurance products. For instance, Revolut includes travel insurance as part of their premium package. N26 provides mobile phone insurance, and Monzo offers home insurance and other types of coverage through their premium offerings.

Neo banks primarily earn from insurance by acting as intermediaries, selling policies on behalf of insurance companies and earning a commission for each policy sold.

This approach contrasts with most high street banks, which often own insurance companies and earn profits directly from the premiums paid by policyholders.

Additionally, banks use insurance products to increase their share of customers' wallets, because it is another proportion of a customer’s income spent on products or services they can capture this way.

Credit cards

Several challenger banks offer credit cards, including Monzo, Starling Bank, Revolut, and N26. Challenger banks, like traditional banks, make money from credit cards in several ways. They earn interest on the money borrowers owe, charge fees such as late payment fees or annual fees, and receive a percentage of each transaction made with the card from the merchant, known as interchange fees.

In order for a challenger bank to start offering a credit card, it needs to take several steps. First, it needs to establish a partnership with a card network, such as Mastercard or Visa. This involves meeting the network's requirements, agreeing and negotiating the terms. Next, the bank needs to design the card's features, benefits, and fees in a way that is attractive to its target customers. This might involve market research and competitive analysis. Once the card is designed, the bank needs to secure regulatory approval, which can be a complex and time-consuming process, therefore they often use a 3rd party banking services provider that issues the cards on their behalf. Therefore the credit card offering is not consistent across all markets the challenger bank operates and may vary from country to country and you do see some credit card / loan only players popping up in a lot of countries.

Loans

Another banking product that became part of the challenger banks portfolio is offering some form of loan, besides credit cards. Many started copying the Klarna like format by offering spreading a payment in 3 or 4 at 0%, but also personal loans in a user friendly way, but another common form of loan is an overdraft, a credit limit that allows you to overspend the funds in your account. Some of the Neo banks started offering personal loans as well, often with not the most competitive rates compared to what high street banks have to offer.

To be able to offer this the bank must also comply with all relevant financial regulations and laws. This includes conducting proper due diligence on loan applicants and maintaining transparency in their loan terms and conditions.

The bank should also have a well-defined loan recovery process in place. This involves setting clear expectations with customers about repayment schedules, handling defaults professionally and ethically, and working out feasible repayment plans with customers who are struggling to repay their loans.

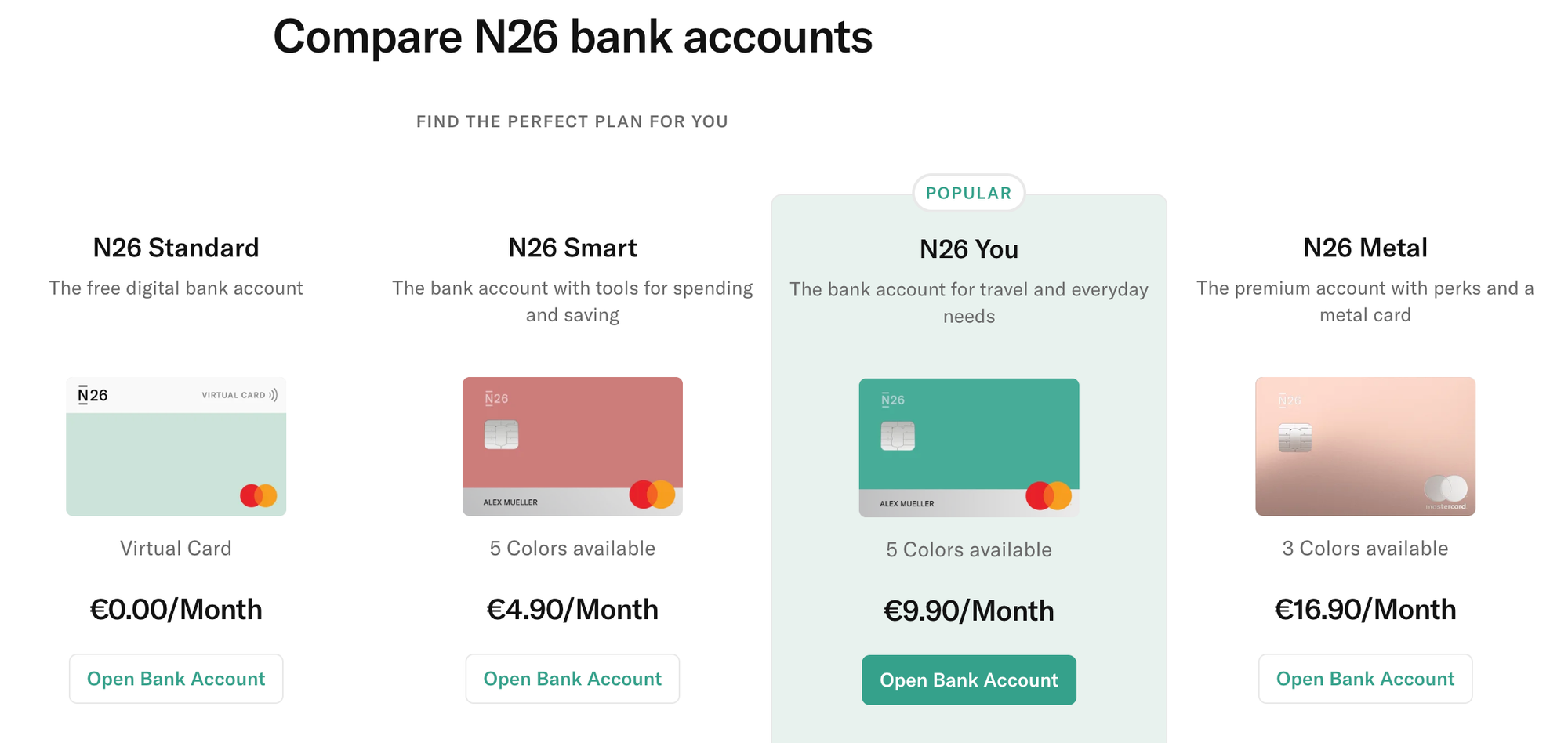

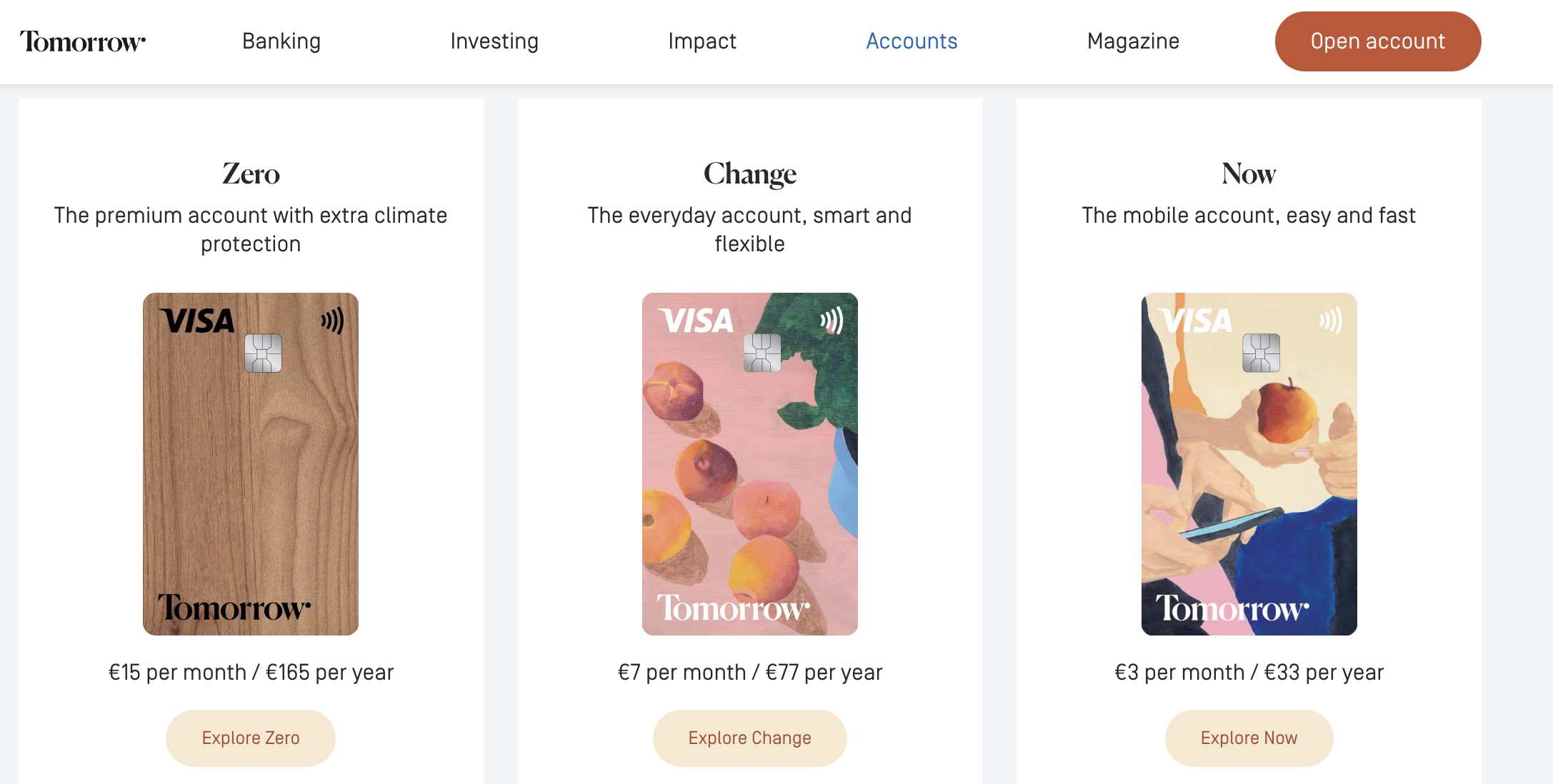

Premium accounts

Challenger banks are now offering premium accounts as a method to increase their Share of Wallet. These accounts often come with a host of perks such as higher interest rates, lower fees, and exclusive services. By providing more value to their customers, challenger banks can attract more deposits and increase their share of customers’ banking business (Share of Wallet). Many of the products and services discussed earlier in this blog are part of such a premium account.

Travel booking

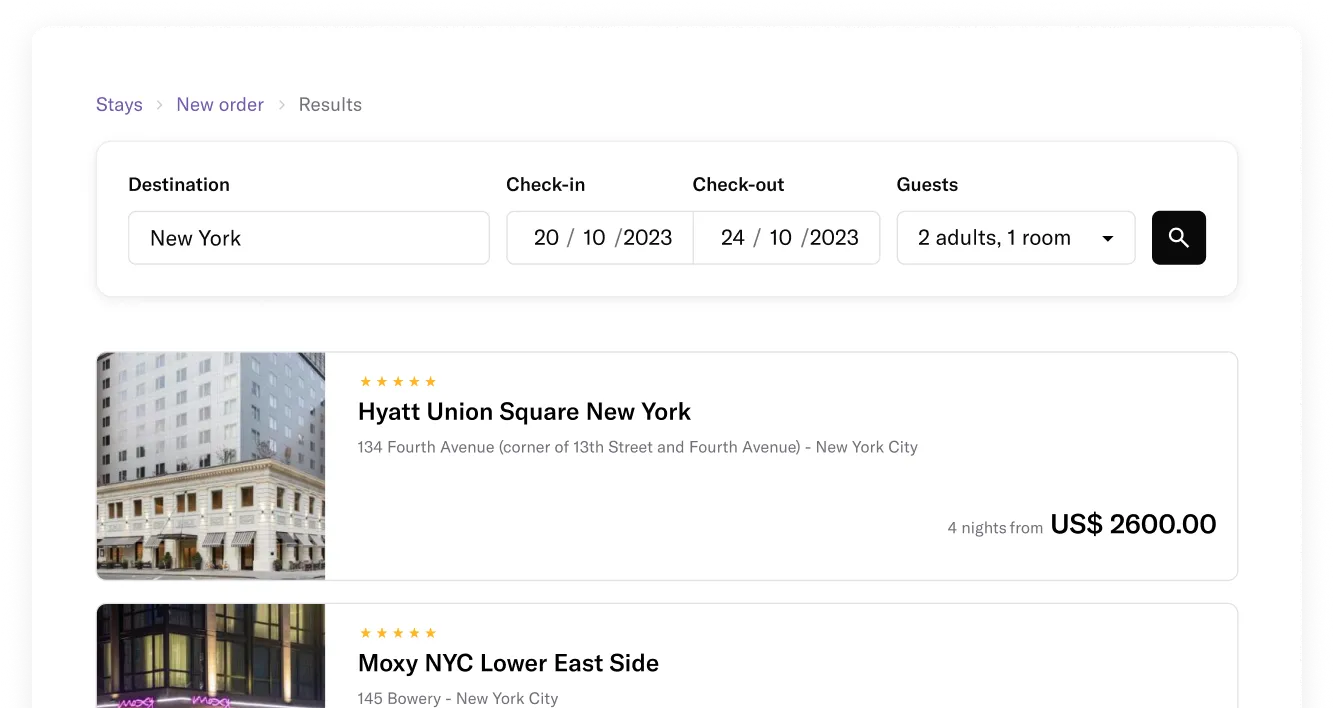

Banks like Revolut have started to offer travel services through third-party providers, including bookings for hotels, cars, taxis, and train tickets. Some banks have partially embedded third-party travel booking tools through i-frames, which increases their Share of Wallet mainly through affiliate fees earned by referring their customers to these third-party booking tools. These tools sometimes appear to be a part of the bank itself, but most of the time, they are actually third-party online travel agencies. Most challenger banks have not really explored travel booking yet, but do offer travel-related services, like lounge access or travel insurance, through premium accounts.

The potential to increase the Share of Wallet by offering travel bookings is significant. Not only can challenger banks earn commission through airlines, hotels, or car rental companies and of course with the interchange fees, but the potential for upselling and cross-selling other services they already offer is substantial. These services could include travel insurance, holiday payment plans, cash back offers, and more.

Therefore, the full potential of selling travel for a challenger bank lies in becoming the "travel seller" themselves and get access to a $1 trillion market. Solutions like Duffel offer multiple ways to integrate their travel booking tool into banking apps, allowing challenger banks to quickly become their own travel sellers and start upselling and cross-selling other services simultaneously.

Learn more here or get in touch with one of our travel booking tool consultants and get your business started with selling travel and driving some incremental revenue!

In conclusion, challenger banks are exploring a wide range of strategies to increase their Share of Wallet. These strategies include offering incentives like cash back, providing saving products and deposits with competitive interest rates, and branching out into investment and insurance products. They also include issuing credit cards, offering personal loans, creating premium account options, and even venturing into travel bookings. Each of these strategies not only brings in direct revenue but also deepens customer relationships, increases loyalty, and allows for a multitude of upselling and cross-selling opportunities. It's clear that the potential for growth and revenue in the challenger banking sector is substantial, with innovative approaches to traditional banking services at its core.

Latest posts

Rippling chooses Duffel to power Rippling Travel

Data-Driven Travel: Using Analytics from the Duffel API to Make Smarter Business Decisions

Our latest blog post explores how companies and developers can use this tool to make smarter business decisions. Learn how to leverage booking data, implement dynamic pricing models, and use predictive modeling for future planning.

How to Take Flight: Accessing Airline Booking Capabilities to Sell Tickets

Selling flights can level-up your customer offerings... but it's complex! Our latest blog simplifies the process.

Rippling chooses Duffel to power Rippling Travel

API

Data-Driven Travel: Using Analytics from the Duffel API to Make Smarter Business Decisions

Our latest blog post explores how companies and developers can use this tool to make smarter business decisions. Learn how to leverage booking data, implement dynamic pricing models, and use predictive modeling for future planning.

How to Take Flight: Accessing Airline Booking Capabilities to Sell Tickets

Selling flights can level-up your customer offerings... but it's complex! Our latest blog simplifies the process.