If you’re building a new travel business, it goes without saying that you need to make money. To do that, there are a series of hurdles to overcome including finding the right payments provider, getting approval in a high-risk industry, managing cash flow, and setting the right pricing in the competitive market.

The flight payments process is complex but it doesn’t have to be. Let’s explore what happens behind the scenes of a passenger booking and see how Duffel is streamlining the process.

Understanding the complexity of flight payments

Who is involved in the flight payments process?

When it comes to selling flights, travel sellers need to navigate a complex web of stakeholders including data and financial processing companies, industry bodies, customers and airlines.

Customers – Customers could be an individual traveller booking a flight for themselves, a friend, family member, or colleague. Or they could be a travel manager booking flights for employees at their company. Customers are looking for a trustworthy platform that accepts their preferred payment method with as little friction as possible.

Travel sellers – Travel Management Companies (TMCs) and Online Travel Agents (OTAs) present flight options to customers from airlines as well as ancillaries and upsell opportunities. Travel sellers want to use a platform that’s secure, compliant with industry standards, has low fees, offers fast payments and refunds, and an easy-to-use interface for their customers.

Payment gateways – Payment gateways are the first step in the payment process to authenticate and either approve or decline a transaction. Payment gateways focus on providing a secure and encrypted service with limited risk. They have a business interest in updating and offering new payment methods – think Buy Now Pay Later , mobile payments like Apple Pay and Google Pay, and cryptocurrency payments.

Examples of payment gateways include Adyen, Authorize.Net, Bolt Payments, Checkout.com, Stripe, Square and PayPal.

Payment processors / Payment Service Providers (PSPs) – PSPs are the second step in the payment process. This service executes the transaction once it has been authenticated by the payment gateway. In many cases, PSPs will also offer payment gateway services. They focus on providing a secure, reliable, and industry-compliant platform.

Examples of PSPs include Adyen, Braintree, PayPal and Stripe.

Airline aggregators – These intermediaries enable travel sellers to access and sell flights, fares, seats and more from multiple airlines. When a customer or travel agent books a flight, the aggregator passes the booking information to the airline and transaction details to a transactional settlement service. An example of an aggregator is a Global Distribution System (GDS).

Transaction settlement services – There are two main services used for settling transactions worldwide:

- IATA Billing and Settlement Program (BSP) and is used for businesses operating worldwide.

- Airlines Reporting Corporation (ARC) is a similar service for businesses operating in the United States.

These services streamline transactions between thousands of global travel agents and hundreds of airlines. They focus on industry-wide compliance, lowering the risk of fraud, and speed of remittances between parties.

Airlines – The main priorities of airlines for flight payments are to maintain reliable and secure systems to handle transactions quickly and with low fees. Increasingly, airlines are looking to have more insight into passenger booking data which has traditionally been handled through intermediaries.

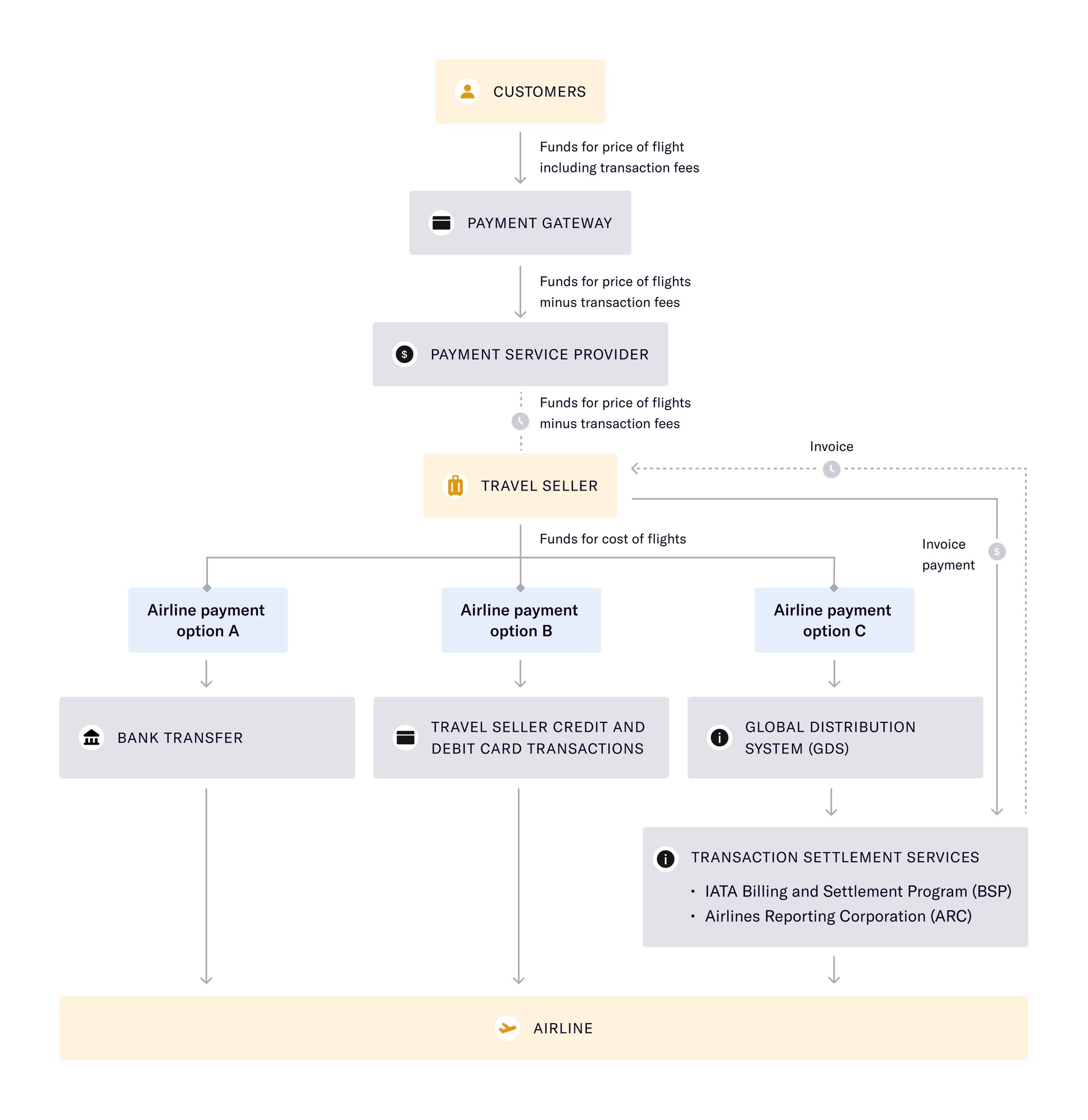

What is the typical flight payment flow?

The flight payment flow is two-sided: payments between a customer and the travel seller; and payments between the travel seller and the airline. Travel sellers will need to manage the complexity on both sides themselves by navigating industry regulations, expensive application fees, opaque processes, and inconsistent airline payment methods.

Below is an example of a flight payment flow where the travel seller is the Merchant of Record (MoR):

Even in this scenario, there are variations and subtleties that could change depending on the travel seller and agreements in place. For example, sometimes the travel seller will forward all of the payment details to the GDS and it’s the GDS that will be connected to the payment gateway.

What should new travel sellers consider when getting started with flight payments?

Being the Merchant of Record

The Merchant of Record (MoR) plays a key role in a credit/debit card transaction and it’s the name that appears on the customer's card statement. They are the company that collects payments directly from a customer in exchange for providing services (e.g. finding the right flight or travel package). Being the MoR also means travel sellers are liable for any fraudulent transactions, chargebacks or refunds in the event of airline or customer insolvency.

Fraud

When it comes to selling flights, one of the main considerations is fraud. According to IATA, airlines lose 1.2% of their revenue to fraud, amounting to approximately $1 billion per year.

Fraud is becoming more and more common: there was a 61% increase from 2018 to 2019 for airlines, and 28% from 2019 to 2020 in the travel and transportation industries. Travel sellers are responsible for building secure systems with processes and technical infrastructure to tackle the growing trend, however this can bring significant overheads, organisational challenges, and risks for failing to protect customers.

Choosing a Payment Service Provider

To sell flights online, travel businesses need to enlist a Payment Service Provider. The PSP will manage the visible booking form that customers use to enter credit card or other payment details, and they will manage the behind-the-scenes transaction process for funds to be delivered to airlines.

Their expertise is the foundation for a compliant, secure, and reliable online travel business, following Payment Card Industry Data Security Standards (PCI DSS) best practises. An initial setup charge, fees per transaction, and other related monthly/annual fees will be charged for access to the payment services.

However, finding a PSP is easier said than done. Given the high level of fraud in the travel industry, mainstream Payment Service Providers are often not willing to work with brand new businesses as it presents a bigger risk. This leaves new travel sellers to work with smaller PSPs who often charge higher processing fees and may not have the breadth of payment options available.

Travel sellers will need to provide a high cash bond to offset the risk faced by service providers and go through a lengthy approval process. For new travel businesses, this is a deal breaker – it’s the difference between being able to operate and sell flights or not.

Accreditation with transaction settlement services

New travel sellers working with a GDS and using their own Payment Service Provider will also need to achieve accreditation with IATA Billing and Settlement Plan (BSP) and/or Airlines Reporting Corporation (ARC) depending if they’re based outside or within the United States.

New businesses pose higher risk and financial uncertainty. As a result, they’ll need to put down large bonds to establish a line of credit with settlement services. They will also be subject to lower Remittance Holding Capacity – a limit on cash flight sales until a a travel seller has paid a remittance to the airline. Read more about accreditation in ‘Starting a travel business is difficult’.

Alternative flight payment processes

There are three alternatives to the typical flight payments process when travel sellers are managing it themselves: pay airlines directly by credit card, use an ‘e-wallet’ like Duffel Balance, or use a full-service payment solution like Duffel Payments.

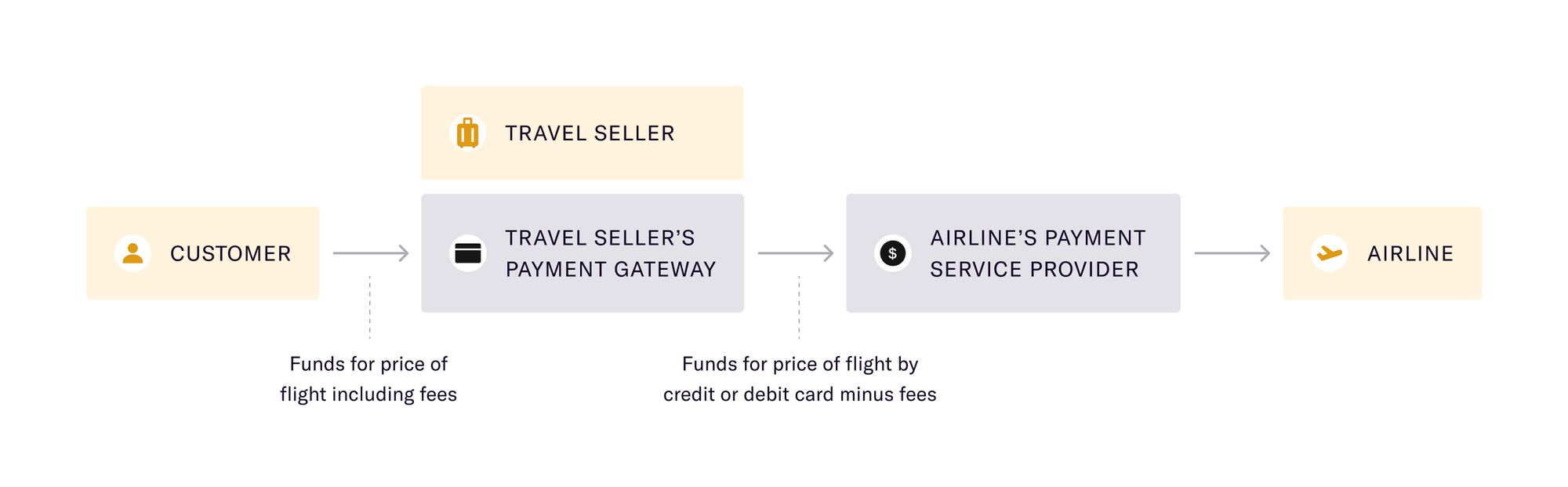

Customer pay airlines directly by credit/debit card

When taken at face value, the most direct payments process for a travel agent involves a traveller paying an airline directly by credit card. Airlines benefit from this system as they receive funds quickly and the possibility for airlines to offer extra revenue-generating services like insurance and airport lounge access. This solution isn’t set up well for travel sellers as there are a number of significant drawbacks for new businesses looking to make money selling flights:

- Travel sellers will need to build their own PCI-compliant infrastructure to handle credit card data that they pass to the airlines – this involves both upfront and ongoing cost and time commitments.

- The process also makes it very difficult for businesses to introduce new revenue streams themselves outside of a GDS as they can only charge travellers’ credit cards once for the cost of the flight and ancillaries without additional profit margin.

- If businesses want to sell hotels, car hire, or non-travel extras, they will still need to work with a PSP and financial intermediaries in the relevant industries. Travel sellers will need to charge customers a second time for any extras.

- The option isn’t available for all airlines which will limit the scope for the travel seller

- Travel sellers still need to work with an aggregator to access flight inventory. This option only allows for payment processing.

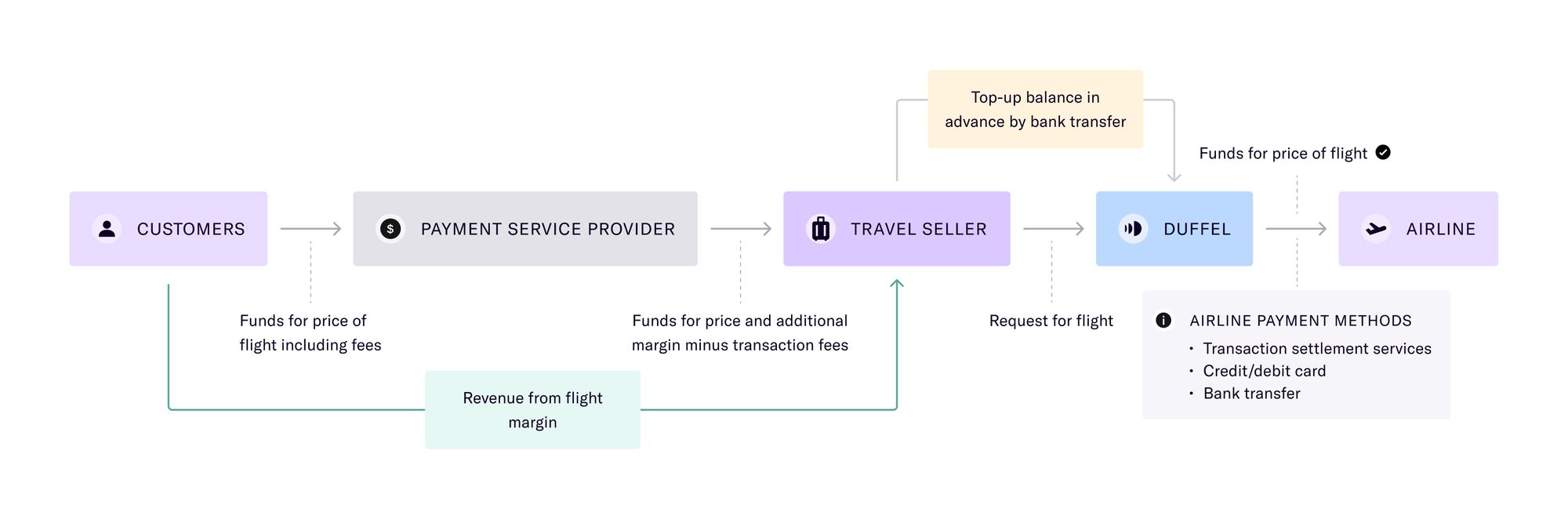

Use an ‘e-wallet’: Duffel Balance

Another option for travel businesses is using an ‘e-wallet’ like Duffel Balance combined with Duffel Flights API. It works by travel sellers topping up the balance with cash before it is needed, then when a customer buys a flight, Duffel transfers funds from the wallet to the airline via their preferred payment method. In comparison to the typical payment flow, the complexity moves from the travel seller on to Duffel.

Travel sellers can charge customers once via the PSP for additional revenue-generating services on top of the flight price and they will only need to top-up the balance to cover the cost of the flight and airline-provided extras.

Airlines benefit from fast payments and no chargebacks – if a customer requests a chargeback, that’s handled between the travel seller and customer. Travel businesses benefit from a secure system with no fees between them and the airline, although they will need to work with a PSP and pay fees to receive funds from travellers.

Airlines accept payments in a number of ways – BSP, ARC, credit card, direct debit – with complicated rules on which they’ll accept depending on who is paying for a flight, where a traveller is based, where the travel seller is based, and the airline’s revenue model. For example, Transavia charges high fees for credit cards, however, they also access SEPA Direct Debit is fee-free. Duffel handles the complexity of paying airlines via their preferred payment method, so travel sellers can focus their expertise on building their business.

Duffel Balance is best suited for existing travel sellers, established businesses outside the travel industry that want to start selling flights, or new travel startups with large investment that can support unpredictable cash flow requirements with surges or falls in passenger demand. New startups would benefit from using Duffel Payments where payment processing is automatic, without the need for top-ups.

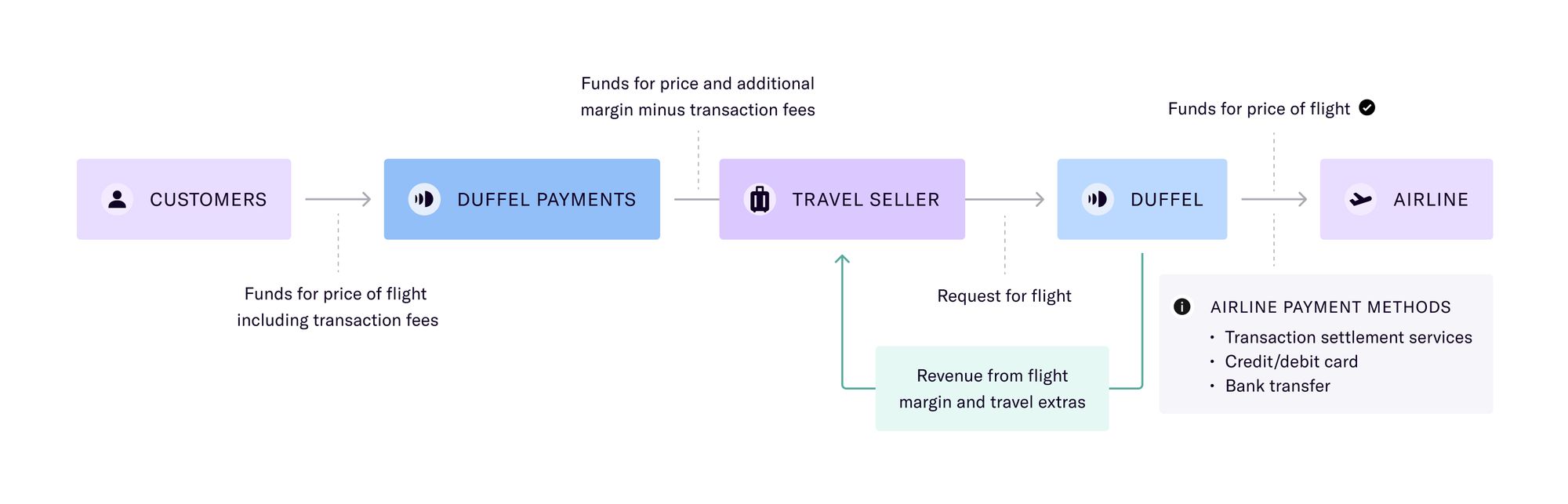

Use a full-service payment solution: Duffel Payments

Duffel Payments has been designed to streamline the flight payments process, particularly for new travel businesses. The platform has been built in partnership with Stripe, one of the industry’s leading Payment Service Providers, to underpin the platform’s security and reliability. Duffel is a full-service solution for flight sellers, combining payment gateway and payment processing services with Duffel Flights API for access to airline content.

New travel businesses can start selling flights with Duffel Payments with no upfront capital or down payments. Duffel manages the risk of new businesses to combat the lengthy application and approval process and the large bonds needed to get started with a PSP and transaction settlement services.

New flight sellers want to get started quickly and travellers want an easy-to-use platform. The Duffel Payments Component is developer-friendly so the booking form can be embedded into a website or app quickly. The component is PCI-compliant, removing the need for travel sellers to worry about handling credit card data, or invest time and money to achieve and maintain compliance.

To improve the experience for both travel businesses and their customers, Duffel Payments handles refunds fast. This means travel seller don’t need to navigate complex rules and fees from airlines – travel sellers can issue refunds direct to customers and Duffel handles everything else behind the scenes.

Making money from selling flights

One of the most common questions from new travel sellers is ‘how do I make money selling flights?’.

Airlines have traditionally operated on small margins and flight sellers have been slow to evolve their revenue models. After a damaging 18 months, there are signs of recovery and investment, and it’s more important than ever for travel businesses to get creative to differentiate themselves from the competition.

Collecting commission from airlines and GDS

Historically, flight sellers made most of their money from commissions from airlines. This could range from 5-8% of the ticket price and was lucrative for large travel sellers. However, the commission model isn’t favoured by airlines as it eats into their revenue where margins are already low.

It's worth noting that airline commissions typically work on a % model whereas aggregators like a GDS pay commissions based on complex tiering and commitments. Today very few airlines offer commission, and when it is available the rates are as low as 1% which isn’t viable for travel sellers to make money.

Adding markups to flight prices

In addition to commission, travel businesses have traditionally made money by adding margin on top of the flight price. This can be a successful option in some cases, however, travellers are very price sensitive and will often look for other sellers or go directly to an airline to find the cheapest price.

To add a margin to the flight cost, travel sellers need to negotiate cheaper prices directly from airlines or flight consolidators. This is difficult for new travel sellers as airlines will only consider negotiating prices with travel businesses that sell a large volume of flights. And with thousands of businesses accessing the same or similar fares, it’s very difficult for new businesses to add margins that cover their costs while staying competitive in the market.

Travel sellers can soften the price sensitivity from passengers by offering a package or bundle of products. Although this will have a higher overall price, any markup on the flight price won’t be visible to customers.

Selling flight extras

When it comes to selling a package or bundle to customers, travel sellers can making money on extras offered by either airlines or other travel service providers.

Extras, also known as ancillaries, offered by airlines have higher profit margins than the flight ticket itself as the cost for service delivery is lower. Examples of these include premium seat options, extra bags, access to a private airport lounge, and meals on the flight.

These are typically included later in the booking flow after the initial flight has been chosen, making it easier for travel sellers to charge more and add markup: travellers are more willing to pay more for extras than to pay more for the base cost of the flight. These extra costs can be easily added to the booking flow with Duffel Payments to create a seamless customer experience.

It’s important to note that flight extras aren’t available from all airlines through aggregators and that this offering isn’t necessarily a differentiator for new businesses entering a competitive market.

Travel businesses can go beyond selling flight extras and bundle related travel extras into their offering to generate more significant revenue. Examples include travel insurance, hotel stays, car hire, experiences and excursions.

Selling lifestyle extras beyond travel

Duffel is empowering a whole new generation of travel businesses – travel businesses can sell and make money on exciting new extras beyond flights and travel. Examples include online grocery shopping delivered when travellers arrive home from a trip or bookable co-working spaces for remote working or meetings.

Duffel Payments puts the travel seller in control and allows for product bundling from day one:

- The travel seller sets the price of the bundle

- The customer pays through the Duffel Payments Component

- Duffel securely passes the funds for the flight to the airline

- Duffel securely passes the additional revenue to the travel seller

5 misconceptions to starting a travel business in 2022

Follow the series to uncover four more common assumptions new flight sellers have about entering into the travel industry.

Up next: how it can be challenging to effectively run a travel operations team and successfully manage this important function.

Explore the series >

Latest posts

Data-Driven Travel: Using Analytics from the Duffel API to Make Smarter Business Decisions

Our latest blog post explores how companies and developers can use this tool to make smarter business decisions. Learn how to leverage booking data, implement dynamic pricing models, and use predictive modeling for future planning.

How to Take Flight: Accessing Airline Booking Capabilities to Sell Tickets

Selling flights can level-up your customer offerings... but it's complex! Our latest blog simplifies the process.

Why does developer experience matter?

At Duffel, we're building the best APIs for selling Travel online. A big part of our "secret sauce" is developer experience. We want to make it not just painless, but fun, to build websites and apps using our APIs.

Data-Driven Travel: Using Analytics from the Duffel API to Make Smarter Business Decisions

Our latest blog post explores how companies and developers can use this tool to make smarter business decisions. Learn how to leverage booking data, implement dynamic pricing models, and use predictive modeling for future planning.

Airlines

How to Take Flight: Accessing Airline Booking Capabilities to Sell Tickets

Selling flights can level-up your customer offerings... but it's complex! Our latest blog simplifies the process.

Why does developer experience matter?

At Duffel, we're building the best APIs for selling Travel online. A big part of our "secret sauce" is developer experience. We want to make it not just painless, but fun, to build websites and apps using our APIs.