Getting started with Duffel

Follow the step-by-step guide to get started and unlock the benefits of your account.

Learn how you and your customers can pay for flights using Duffel Balance or Duffel Payments

Collecting payments in the travel industry, especially for flights, is complex. If you want to learn more about getting started with travel payments, check out our article Processing flight payments is complex from our series on the 5 misconceptions of starting a travel business.

There are two ways you can pay for flights with Duffel:

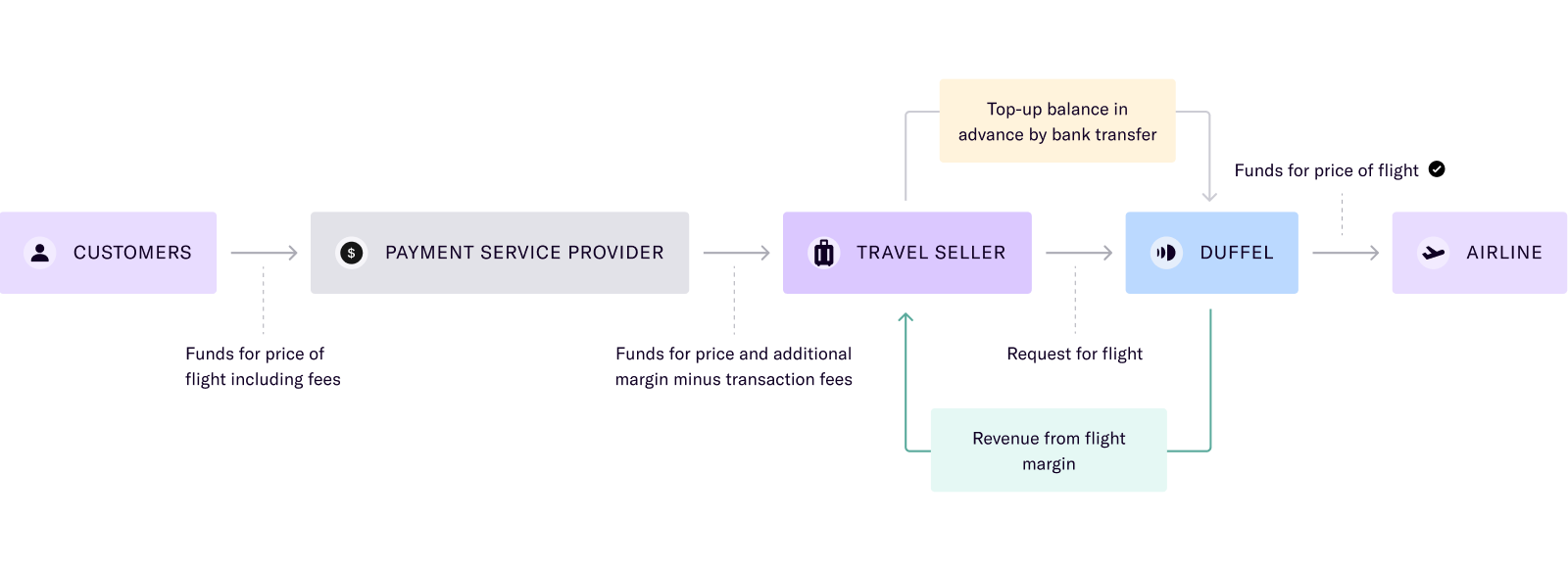

Duffel Balance acts like an e-wallet where you top up your balance by bank transfer. We use those funds to pay airlines for flights. You still need to find your own Payment Service Provider (PSP) to accept payments from your customers.

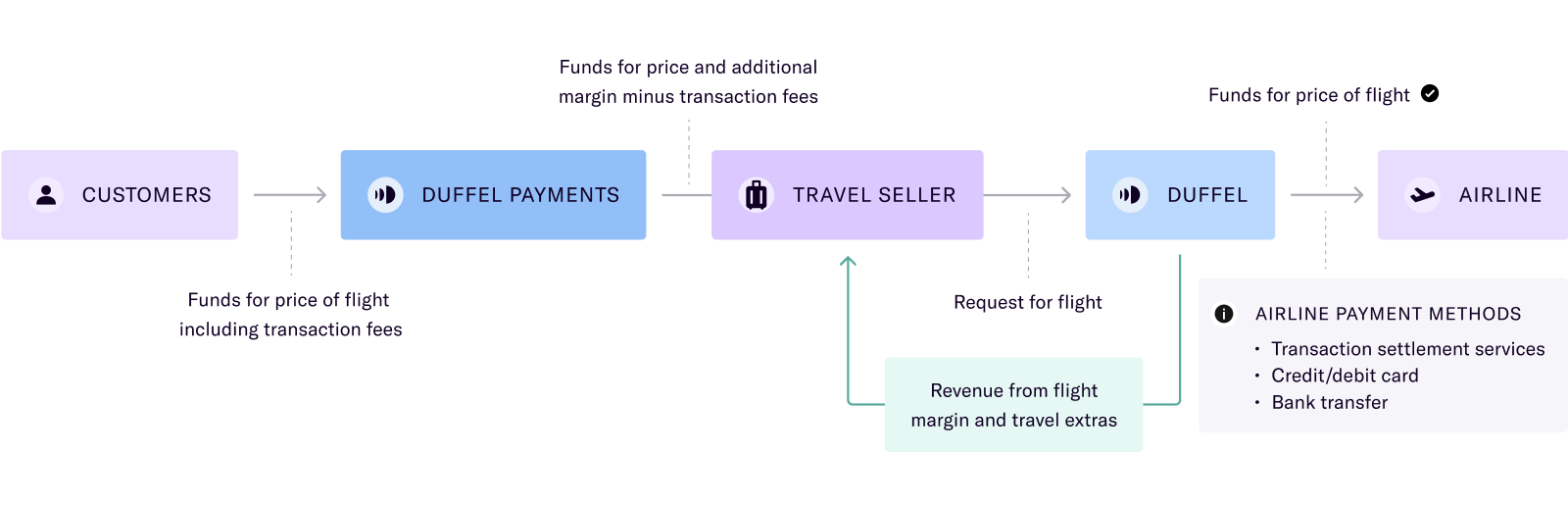

Duffel Payments is an API for charging customers with credit or debit cards and the funds flow directly through to Duffel for us to pay the airline. It’s available for businesses in over 20 countries and allows you to accept payments in 135+ currencies.

Can I choose when to use Duffel Payments and when to use Duffel Balance?

You can switch between Duffel Payments and Duffel Balance at will, and you can even use both at the same time for different customers or different bookings.

Duffel Balance can be used by existing travel sellers or established businesses outside the travel industry that want to start selling flights.

New travel businesses with large investment that can support unpredictable cash flow requirements with surges or falls in passenger demand can also benefit from using Duffel Balance.

Travel sellers start by topping up the balance with cash before it is needed, then when a customer buys a flight, Duffel transfers funds from the balance to the airline via their preferred payment method.

In comparison to the typical payment flow, the complexity moves from the travel seller on to Duffel.

Travel sellers can charge customers once via their PSP for additional revenue-generating services on top of the flight price, and they will only need to top up the balance to cover the cost of the flight and airline-provided extras. Everything else is margin that the travel sellers retain.

Since Duffel handles the complexity of paying airlines via their preferred payment method, travel sellers can focus their time and energy on building their business.

In order to use Duffel Balance, travel businesses will still need to work with a PSP and pay fees to receive funds from travellers.

When you set up your account, depending on where your business is based you may be presented with the option to make your first Duffel Balance top-up using your credit/debit card. This is shown during onboarding, and this top-up will arrive in your account immediately.

If credit/debit card payment is available, you can make the payment from any card issuer, including electronic banks.

After this first top-up your balance can be topped up via two methods only:

As you are familiar with operating a business, card transactions are expensive to process. If we enabled card payments for all top-ups, unfortunately, we would need to increase prices to cover the costs.

Your balance will be topped up as soon as it clears our bank account. This is automated provided you included the reference number for your balance.

The time it takes to reflect in your balance can depend on the payment type, your bank, and the time zone you operate in.

Duffel Payments is best suited for new travel businesses as they may not have the cash flow to handle pre-payment for flights or have difficulty getting approval from a PSP.

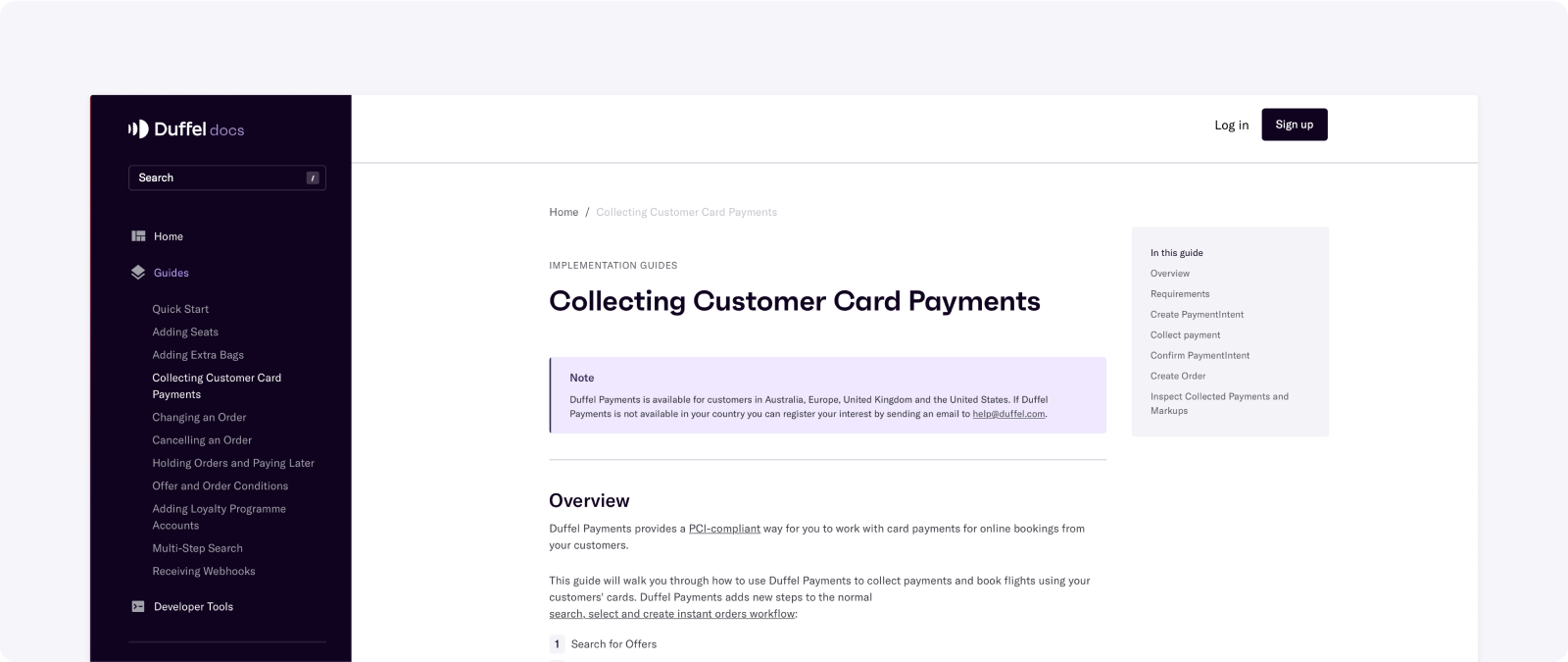

Travel sellers start by integrating Duffel Payments and choosing either to use our PCI-compliant Payments component on their website or to build out the functionality themselves.

In comparison to the typical payment flow, our Payments API allows you to seamlessly handle payments through to the airline without having to manage cash flow upfront in the Duffel Balance. You can also easily handle refunds, reconciliation, and markup.

Travel sellers can offer their customers the option to pay by any major card such as Visa or Mastercard, across 135+ currencies. Travel sellers also control the price the customer sees and can retain any additional markup as profit.

Duffel Payments helps travel sellers by managing the risk of new businesses to combat the lengthy application and approval process and the large bonds needed to get started with a PSP and transaction settlement services. We also don’t require any upfront guarantees or approvals.

Duffel Payments is not currently available in every country. The 22 countries currently accepted are:

UK: United Kingdom

Europe: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, Spain

Australia: Australia

US & Rest of World: United States

When you sign up, select the country for your team. If your country is one of the 22 accepted for Duffel Payments, you will then have access to implement it.

Next, explore our guides to learn more about implementation:

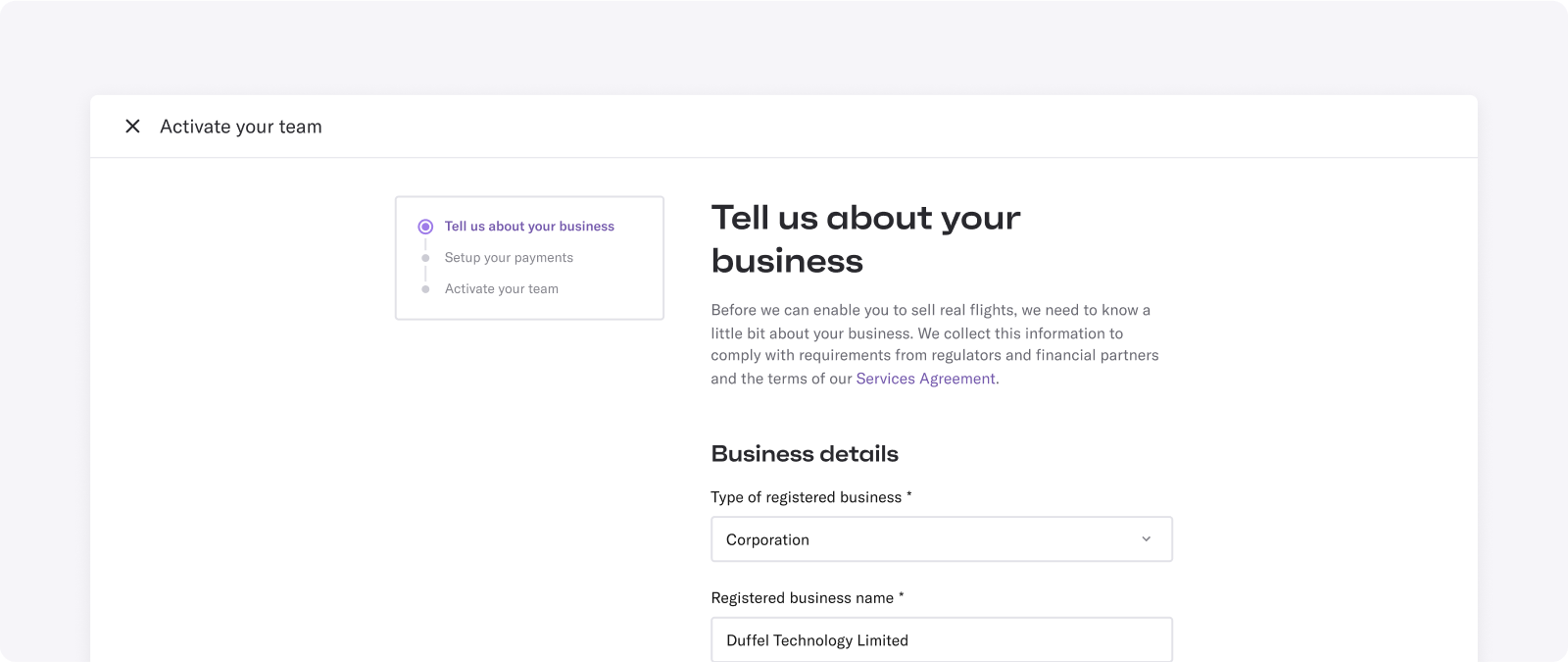

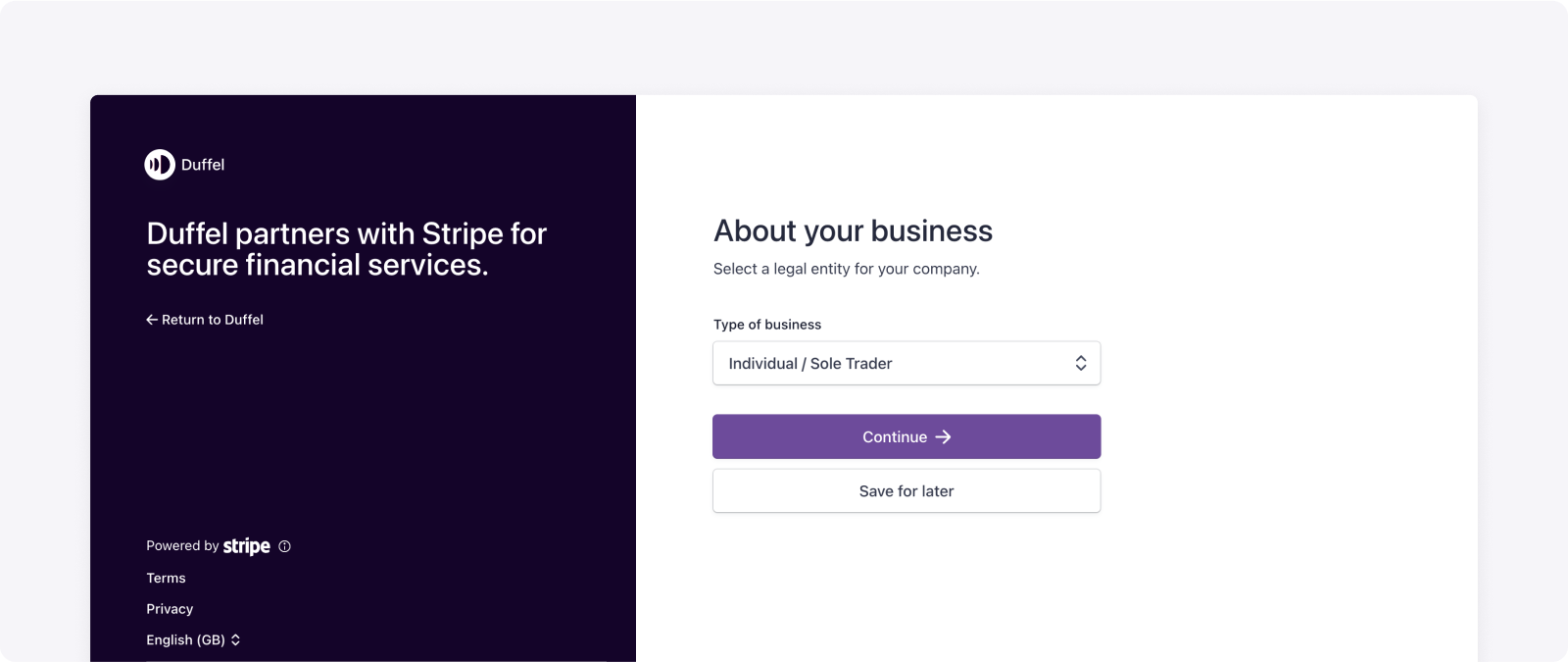

When you’re ready to take live payments for flights, you’ll need to verify your organisation by selecting Activate your team in the app.duffel.com homepage. You'll then be guided through our verification process. This is not required for use in the test environment.

Duffel Payments can be used to take customer payments for any airline you can access through the Duffel platform.

View the full list of airlines

We support all major card types today, including Visa, Mastercard, American Express, and Discover.

We do not yet offer support for e-wallets (Apple Pay for example) or Buy Now Pay Later payment methods. If there are additional payment types you need to serve your customers please contact us at [email protected]

If you are already using alternative payment methods you can use alternative payment providers and top-up your Duffel Balance in the Dashboard to pay for flights using bank transfers.

You charge your customer in 135+ currencies.

Duffel Payments effectively acts as the acquirer, providing the infrastructure to accept credit and debit card payments. It is primarily targeted for use to instantly pay airlines as part of the booking process, but can also be used to take payments for other services too.

It isn't possible to use your existing Stripe account with Duffel Payments. You would have to set up a new Duffel Payments account. But you could choose to use Duffel with your own Stripe account separately. Here are your options:

If you already have your own existing payment processor, you can absolutely use that.

You can also choose Stripe for your payments, or you can use Duffel Payments. They both allow you to collect card payments from your customers.

The big benefit of Duffel Payments is cashflow - you don't have to top up your Duffel Balance ahead of time, pay for customer's flights, and then get the money to cover those flights from your card provider/Stripe later. It's all integrated instead and the money you’ve collected from your customers is available immediately to book flights.

No, you don't need to do that. You can utilise Duffel Payments to charge cards, and you can also utilise the Duffel Balance concept to top up your balance and pay for flights that utilise your own payment mechanism that way. For this you'll need some cashflow in place.

If you are based in a country that isn’t currently available, we might be able to work with you if you have a legal entity (company) in another country.

If you're not able to use Duffel Payments, that doesn't mean that you can't use Duffel. It just means that you would need to use another payment gateway to accept payments from customers, and then you'd have to pay Duffel using the Duffel Balance.

Yes. At the time of booking any remaining funds required to cover the cost of the flight, beyond what's taken in the card payment, will be taken from your Duffel Balance. It is your responsibility to ensure you have enough money in your Duffel Balance to cover the total price of the flight or the order will fail to go through.

You can do this by topping up your balance via bank transfer.

You will receive notifications if your balance is low.

Yes. For example, you could charge a customer for a flight, hotel room, and travel insurance in one transaction. Or charge another customer just for a hotel room.

Duffel Payments can be used as a generic payments service provider to charge for other services outside of the Duffel platform, but be aware that to access money to pay other suppliers will require you to manually request a payout.

The business name you see on credit and debit card statements refers to the merchant of record. Your customer will see your business name in their statements as the merchant of record.

Learn more about what it means to be the merchant of record.

Getting started with Duffel

Follow the step-by-step guide to get started and unlock the benefits of your account.

Understanding margin and markups

Learn about adding markup, what's available, and how to determine your margin.

Handling order confirmation emails

Learn how to send order confirmation emails to your customers and what you need to include.